child tax credit october 2021

Published 1 October 2014 Last updated 6 April 2022 show all updates. December 15 2021.

D I Awareness Week National Apartment Association Naa Multifamily Https Www Naahq Org Diwee Awareness Multifamily Property Management Property Management

The advance Child Tax Credit payments were signed into law as a part of the American Rescue Plan Act in 2021The tool below is to only be used to help you determine what your 2021 monthly advance payment could have been.

. Not too late to claim the Child Tax. Any advance child tax credit payments need to be reported on a 2021 IRS Tax Return. You can find materials to share at 2021 Child Tax Credit and Advance Child Tax Credit Payments.

6 April 2022. The Child Tax Credit and Working Tax Credit leaflet has been added for tax year 2021 to. The 2021 child tax credit is available for parents and guardians with children who are under age 18 and have a Social Security number.

Paying for childcare and dependent care can be very expensive. The maximum child tax credit is 3600 per child under age six and 3000 per older child. The Child Tax Credit is designed to help with the high costs of child care and rising number of children in poverty in the United States.

Below the calculator find important information regarding the 2021 Child and Dependent Care Credit CDCCThis credit has been greatly changed as part of the third stimulus bill or American Rescue Plan Act. IR-2022-106 Face-to-face IRS help without an appointment available during special Saturday opening on May 14 IR-2022-105 IRS provides guidance for residents of Puerto Rico to claim the Child Tax Credit IR-2022-91 Taxpayers who owe and missed the April 18 filing deadline should file now to limit penalties and interest. Fortunately there is a tax credit to help defray the costs.

If you had to pay someone. This tax credit has helps millions of families every year and has been increased with the Trump Tax Reform. The Child Tax Credit under the American Rescue Plan rose from 2000 to 3000 for every qualified child over the age of six and from 3600 to 3600 for each qualifying child under the age of six beginning in tax year 2021 the taxes you file in 2022.

The IRS urges employers community groups non-profits associations education groups and anyone else with connections to people with children to share information about the Child Tax Credit expansions for the 2021 tax year.

H R Block Reports Revenue Growth In Fiscal 2021 Second Quarter Hr Block Revenue Growth Dividend

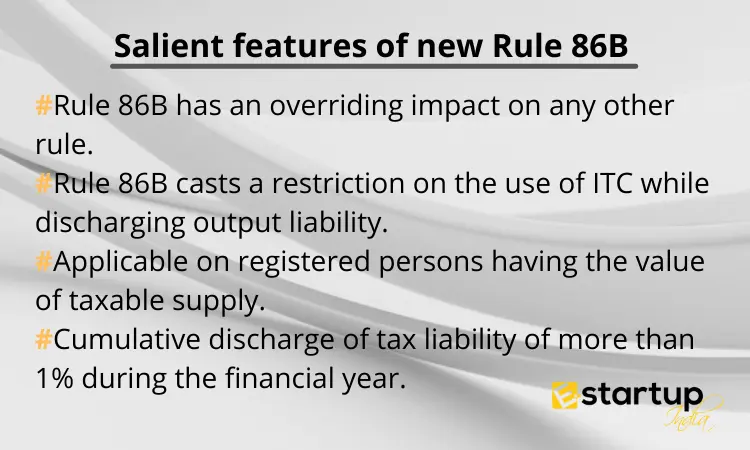

Gst Input Tax Credit Tax Credits Indirect Tax Tax Guide

Salient Features Of New Rule 86b Rules It Cast Feature

October 2021 Cpa Exam Changes Cpa Exam Cpa Cpa Review

Tds Due Dates October 2020 Dating Due Date Income Tax Return

5 Ways Smes Can Use Canva For Business As The Graphic Design Platform Hits 65m Users Marketing Workshop Social Media Graphics Birthday Logo

Tax Due Dates Stock Exchange Due Date Tax

Pin By Tax Consultancy On Tax Consultant Tax Deductions Bank Statement 1st Bank

Tax Return Deadlines 2021 Tax Deadline Tax Return Deadline Tax Refund

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Doorstep Banking India Post Payments Bank Ippb Banking Free Banking Opening A Bank Account

Pin On Fighting Fraud And Scams

Wipe Clean Workbook Uppercase Alphabet In 2021 Uppercase Alphabet Workbook Cleaning Wipes

Child Tax Credit Could Spur 1 5 Million Parents To Leave The Workforce Study Says Cbs News